In previous blog posts, we’ve discussed the role of natural gas in electricity price formation. Natural gas-fired power plants can ramp up and down during each operational day, so they complement renewable energy’s cyclical intermittency. However, this setup also means that the natural gas fleet sets the power price based on its marginal dispatch cost. Since 90% of this electricity cost is the cost of the underlying fuel, the electricity market price is heavily correlated with the natural gas market price. This leads to the need for a costless collar.

Operators of natural gas-fired power plants and other gas consumers, such as industrial facilities, refineries, and local distribution companies, have a long-term supply need called a “short position.” But since natural gas prices are subject to long-term movement and short-term volatility, most large users use an array of financial hedging alternatives to manage their exposure to these risks.

In addition to futures and forwards, numerous other financial products are available. One of these is a “price collar.” It can be done at no cost if carefully crafted, hence the name “costless collar” or “zero-cost collar.”

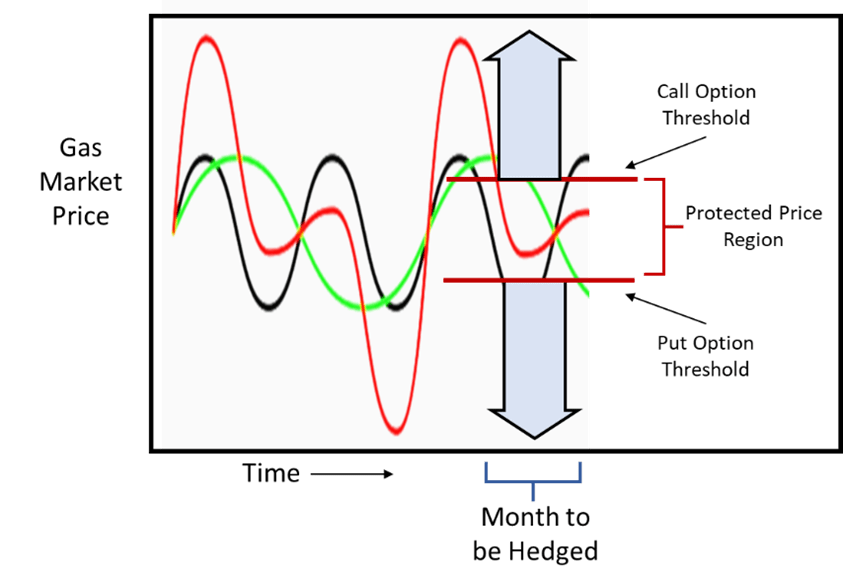

What is a collar, and how is it costless?

A collar is simply the combination of two options that create a price ceiling and a price floor for a commodity at some future period (usually a coming month). For example, for a consumer of natural gas, the price ceiling is created by purchasing a call option at a specific strike price above the current market (out-of-the-money call), and the price floor is created by selling a put option (for the same quantity) at a strike price below the current market. In this way, regardless of where the price for the target month goes, the consumer has maintained their gas price within the bounds of the collar.

Each “leg” of the collar, both the call and the put, will have a premium attached: the price paid by the buyer for the option. The consumer pays an option premium for the call option, a fee to compensate the seller for their price risk. The consumer will also collect a premium when they sell the put option. The premium amount collected each way is calculated based on a sophisticated analysis of the underlying commodity’s pricing trends and forward curve. Still, a general rule is that the further above or below the current market price (the further “out-of-the-money”), the smaller the premium. By detailed pricing, the cost of the call option premium and the revenue from the put option premium can be matched up, making the collar effectively “free” to the consumer and, therefore, a zero-cost collar.

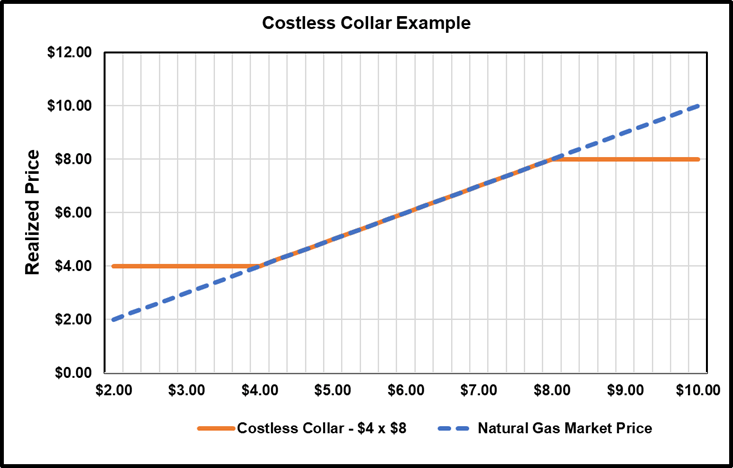

A zero-cost or costless collar example

In our previous blog post, “Natural Gas Mid-Office Functions and Energy Hedging,” we discussed Amy, who purchases natural gas for a company with reasonably well-known future requirements. In January, Amy analyzed the gas needs for her company for the next 12 months. As a result, she determines the need to hedge 5 million MMBTU for next December. In our previous example, Amy covered her price exposure by purchasing forward contracts for December.

Today, let’s suppose that Amy would like to manage this price risk differently due to market dynamics, company risk appetite, or other reasons. For example, she may decide that instead of using forwards, she will use a price collar to ensure the organization’s gas price stays within a set of desired boundaries.

She contacts a hedge counterparty to work out the transaction. The current market for December is $6 per MMBTU. She can buy a call option with a strike price of $8 for a premium of $0.75 per MMBtu. The hedge counterparty is willing to buy a put option from her at $4 for an option premium of $.75 per MMBTU. This amount matches her call option premium, making the two-part transaction. She now buys her $8 call and sells her $4 put, and the premium earned on the put offsets the premium paid for the call.

When December comes, the transactions will be settled with one of three outcomes:

1. If December settles between $4 and $8, there is no financial settlement between her and the hedge counterparty. She buys her physical gas (between $4 and $8) and successfully manages her price target.

2. If December settles above $8, say $8.50 when the $8 call is settled, there will be a hedge gain of $0.50. Amy buys her $8.50 physical gas, but the $0.50 gain returns her cost to $8.

3. If December settles below $4, say $3.50, then when the $4 put is settled, there will be a hedging loss of $.050.So Amy buys her $3.50 physical gas, but a $0.50 hedge loss brings her cost back to $4.

A zero-cost or costless collar strategy

The principal advantage of this tactic is that some measure of hedging can be done for little to no out-of-pocket costs leading to a costless collar hedge. It’s a cost-effective tool and can be valuable to a comprehensive hedging program.

On the downside, matching the call and putting premiums exactly may be difficult or impossible. If they don’t precisely match, there will be some cost to the hedge, which may or may not be acceptable.

The biggest drawback to the costless collar is that the spread between the put and the call may be so broad that it doesn’t produce any meaningful price surety. In the above example, Amy could buy her gas for as little as $4 but as much as $8 for December. This price difference may not be problematic for a company that simply passes through its gas costs (like some natural gas LDCs). But for a fertilizer or plastics company, a 100% increase in feedstock costs could price its products out of the market. Each company must determine whether its risk appetite can tolerate this spread or if it requires a tighter target for natural gas pricing hedging.

Finally, selling an option (a put) involves taking risks. Being short on an option is possible, so there could be credit or liquidity implications to selling the put option.

It’s necessary to have the right tools.

Using sophisticated market tools for natural gas price risk management is a standard practice in the industry. Each tool has its uses, and successful companies know how and when to use them. Managing the data and transactions associated with the hedge program is crucial to success in this endeavor.

PCI’s Energy Trading and Risk Management platform and Gas Management Software seamlessly manages all the functions needed to accomplish this, from deal capture through accounting tie-out. Daily analysis of market movement presents current positions and margin obligations. In addition, the roles of trader, manager, and risk manager are integrated into the solution. As a result, it’s the ideal tool for managing a sophisticated, successful risk management program.